Let's re-think Strategic Asset Management

18 Jun 2021

Let's re-think Strategic Asset Management

Introduction

Strategic Asset Management needs to be centre stage in every organisation to address the challenges they face. Organisations face challenges into the future for example climate change, which will impacts on infrastructure assets and property, exacerbated by COVID-19. There is a need through assets to meet the strategic goals of the organisation, which may imply more effective in the use of physical assets, or even challenging the role of assets in the organisation.

The objective of Strategic Asset Management is to use physical infrastructure assets effectively to achieve an organisation’s mission (vision) defining its strategic goals.

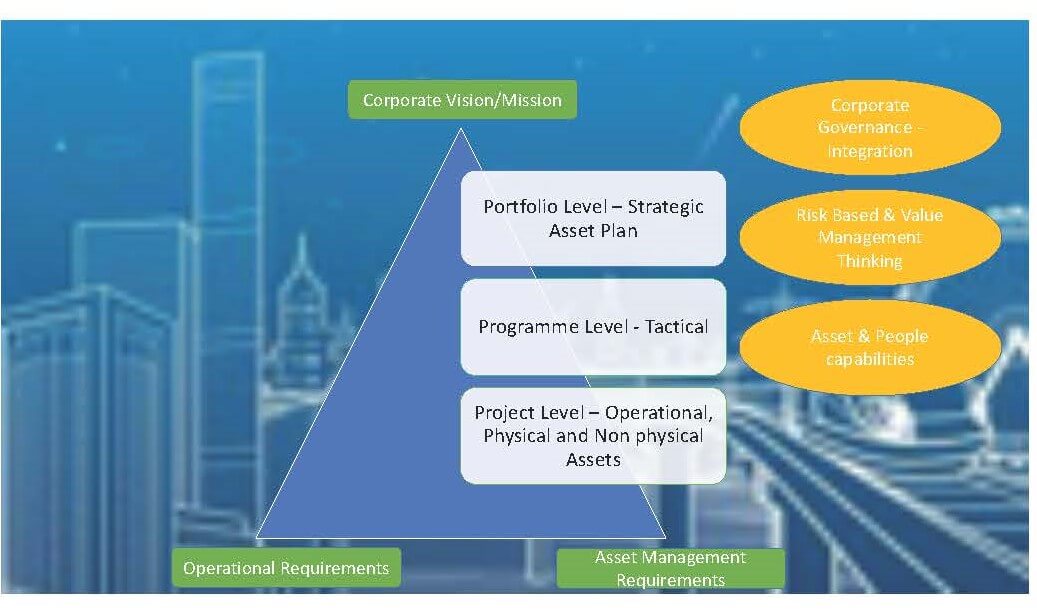

Strategic Asset Management, though, should deliver at a strategic, tactical, and operational level. Our view is Strategic Asset Management should integrate the concepts of Line of Sight, Risk Based and Value Based Management Thinking, whilst taking into account the organisation governance. Whilst each concept represent ‘mindsets’ for managing assets their integration will deliver more successfully an organisation’s mission.

Strategic Asset Management prioritises the whole life investment in physical assets strategically, involving investment trade-offs between capital and operational expenditure on physical assets in terms of a Total Expenditure (TOTEX) ‘mindset’.

The key is alignment of asset management with the organisation’s overall strategic goals using assets deliver the Asset Value and risk-based thinking. This requires ensuring that organisational capability through Portfolio, Programme and Project Management has also been underpinned with value and risk-based thinking using Line of Sight to tackle future potential scenarios. This will require change given the challenges organisations face and emphasises the need for agility through effective management of change. Again, breaking down a silo mentality with a holistic organizational ‘mindset’ is also important.

The outcome is an organisation that employs assets to deliver its vision, ensuring spending is in the right places and occurs at the right time, such that assets are making a positive contribution creating long term value to an organisation. As illustrated by the Covid-19 pandemic, there needs to be organisational resilience and recovery, so organisations’ Boards can reassess their positions and look for more control over their long-term expenditure.

BS 65000:2014 Guidance on Organizational Resilience, defines this as “the ability of an organization to anticipate, prepare for, and respond and adapt to everything from minor everyday events to acute shocks and chronic or incremental changes (pp 1). The focus of this article, whilst addressing at times Covid-19 as one example of a potentially chronic shock, explores the notion of Strategic Asset Management as an organisational capability that has an important contribution to make to the concept of organizational resilience.

Current Environment and Challenges

Challenges permeate organisations from both the business and natural world. Abrupt changes, such as the financial crash of 2008/09 or the current pandemic, or for that matter the likely consequences of climate change on infrastructure assets, cannot be treated by ‘business as usual’ activities. There has to be transformational thinking. The capability to deal with sudden shocks requires sustainable and resilient approaches. Assets must be a part of the solution. Asset Managers will require flexible and strategic thinking that allows an organisation to manoeuvre around challenges and ensure their asset base and consequently their organization remains resilient into the future.

Asset Managers’ strategies should respond to changes in organisational mission and the challenges faced in the new ‘normal’ established by the Covid pandemic and beyond. They should be capable of contributing to the corporate debate on re-alignment to ensure the effective use of resources: human, monetary and physical infrastructure assets.

Innovative transformation is required to deal with new futures. With the capability to assess where an organisation is currently and where it needs to be in the future, being able to identify the current knowns and unknowns. A ‘mindset’ is required with clarity for developing new thinking to confront the emergent challenges for an organisation, determining which strategies and actions need to be taken, or those actions that should not be taken. From this, resources can then be planned to fulfil what is required. Equally, a ‘mindset’ of continuous review must be an endemic capability in an organization to ensure aspects are not missing, overlooked, and should be incorporated into the future direction.

Risk and Resilience

Management Boards now face quite significant challenges, the parameters of which are likely to be shaped by constrained resources going forward. Consequently, this brings with it significant risks, especially during and beyond the current turbulent environment to ensure the organization is not diverted from its mission. The pandemic, amongst other shocks, has reinforced clearly the need for organisational resilience, flexibility and a need to look at what resilience may mean across an organisation’s activities, including its asset base.

Corporate Risk Governance provides a way forward, but it requires appropriate reporting and monitoring of changes inside and outside the organisation. It should identify root causes of challenges but also opportunities and be competent to overcome them.

Physical infrastructure assets, as an enabler of organizational purpose and mission, bring with them opportunities, liabilities, and risks. A holistic ‘mindset’ stemming from the perspective of a Strategic Asset Management approach sees an asset management capability as an important part of the Corporate Risk Governance framework. The notion of the Line of Sight, a core aspect of asset management, has inherent within it the alignment of decisions, vertically and horizontally within an organisation. It should take into account the Institutional environment of legislation, regulation and government at all levels. The emphasis is not simply on current context but future potential changes. Within this governance framework, the Line of Sight is also about the alignment of both risk and value within corporate decision-making, and not one separate from the other; they are inseparable and intertwined in all decisions within a Strategic Asset Management, as is a life cycle ‘mindset’ within this.

Value Thinking

To bring about effective and efficient ways of thinking and doing within an organisation, it is imperative that value and business risk thinking is combined holistically. Value based thinking has at its core addressing what value means for an organization and importantly, why. It also involves asking tough questions around why invest in these assets now, and over what timescale is that investment required. Decisions around investment

also entail trade-offs about other opportunities for investment – a critical aspect of value judgements. Equally, this entails assessing the business risk associated with delivering that value, and importantly the cost, not just currently but over time (life cycle value and risk). Thinking in this way ensures organisations have choices so that decisions can be made using monetized value decisions against business risk.

This also helps organisation weigh up at Strategic, Portfolio, Programme and Project levels the parameters of value, risk and cost, which the organisation needs to ensure it makes the right choices and decisions in asset investment planning, namely, a TOTEX based approach.

Inevitably, this must involve making trade-offs. A ‘mindset’ of intertwined value and risk-based thinking ensures decisions will be made appropriately within the right governance framework and using time-based life cycle thinking. This is especially where the management of physical infrastructure assets is concerned with their whole life management. This clear and transparent ‘mindset’ helps organizations to be more flexible and resilient in challenging times.

Influencing Corporate Governance

Corporate governance comes very much to the forefront of scrutiny of organizational decision- making during very challenging times.

Governance is the system of rules, practices, and processes by which an organization is directed and controlled; it requires transparency of decision-making. In these very uncertain times, organizations are vulnerable to scrutiny and challenge from perhaps a diverse range of stakeholders; and hence a focus on governance and transparency in decision-making is all important.

This requires an Asset Manager to be able to influence appropriately Senior Management and through them the Board. It is about understanding the structure of the organisation and the levers that can be used to achieve this.

Focusing on Strategic Asset Management

The view of the authors is that Strategic Asset Management should be research-led, aligning physical infrastructure assets to deliver the corporate mission. As an organisational capability, it involves making investment decisions for the through-life management of physical infrastructure assets and requires orienting an organisation’s ‘mindset’ and culture towards this. To implement effectively, it requires leadership at all levels of an organisation.

Transformation of physical infrastructure asset management requires both state-of-the art knowledge and skills, and the clarity on the organisational change that will achieve this. There is a need to gain acceptance of the vision throughout an organisation from Board level to shop floor.

An Asset Management capability is a key enabler of the Corporate Mission. It brings together the four elements of Line of Sight, a Life Cycle perspective, Risk Based Thinking, and Value Based Thinking. It also has to bring together Asset Management thinking with that of Portfolio, Programme and Project Management thinking. These disciplines are very closely interwoven as a more comprehensive organizational capability for dealing with physical assets.

Most importantly though, it places this ‘mindset’ clearly in a corporate context for aligning and implementing the overall strategic direction of the organisation with its physical asset base to address the challenges ahead. To implement this comprehensively in an organization, such that it becomes embedded deep within organisational culture and behaviour, will require the management and leadership of change. The goal is therefore to develop Asset Managers to become empowered to make transformative Impacts in their organisations and ensure that assets are seen as enablers of strategic and transformative change during periods when the resilience or organizations are clearly under threat.

The Authors

The authors are members of the Steering Group involved in developing the University of Edinburgh Business School’s (UEBS) course in ‘Strategic Asset Management for Transformational Innovation’, which has brought together academics and representatives from asset-intensive organisations and strategic consultancies.

Professor Jake Ansell is Deputy Director of Research (Knowledge Exchange) and Course Leader for ‘Strategy Asset Management Transformational Impact’. Jake has been a consultant on Risk for both Government and Industry, especially utilities. He published two books on Risk and Reliability along with over 60 papers.

Manjit Bains is Director of Asset Management Business School, with experience in strategic consultancy, and Asset Management training internationally. Manjit is Chair of the Institute of Value Management, and Coordinator of the course ‘Strategic Asset Management Transformational Impact’.

Dr Steve Male is a Visiting Fellow in Infrastructure Asset Management, Department of Civil Engineering, University of Bristol, and former Professor of Property and Infrastructure Asset Management, University of Leeds. Steve chairs the Steering Group for Strategic Asset Management Transformational Impact. He is currently co- authoring a book on Strategic Infrastructure Asset Management for Wiley, due for publication in the Spring / Summer 2021.

For further details on the UEBS course, whose design reflects the key principles set out above, please call our Executive Education Team on 0131 651 5245 or send an email to executive@business-school.ed.ac.uk.